Introduction

What Is Administrative Accounting?

Roles & Responsibilities of an Administrative Accountant

Why Is Administrative Accounting Important in an Organisation?

Administrative Accounting vs. Financial Accounting

Example of Administrative Accounting

Qualifications for Administrative Accountants

Pursuing a Career As an Administrative Accountant: Is It Worth It?

Conclusion

Introduction

Unlocking the intricacies of an organisation's financial health requires a meticulous understanding of various accounting domains. One such critical aspect is Administrative Accounting, a niche that plays a pivotal role in steering the ship of corporate finances. In this exploration, we'll delve into the depths of Administrative Accounting, examining its essence, significance, and the journey to pursue a career in this field.

What Is Administrative Accounting?

Administrative Accounting, often referred to as management accounting, is the specialised branch of accounting that focuses on providing internal stakeholders with relevant financial information. Unlike financial accounting, which primarily caters to external parties like investors and regulators, Administrative Accounting is tailored to meet the needs of management for informed decision-making.

At its core, Administrative Accounting involves the collection, analysis, interpretation, and presentation of financial data to aid managerial planning, control, and decision-making processes. This dynamic field adapts to the unique requirements of each organisation, offering a versatile toolkit for navigating the complexities of business operations.

Roles & Responsibilities of an Administrative Accountant

Administrative Accountants wear multiple hats within an organisation. They act as financial strategists, interpreters of data, and advisors to the management team. Some key responsibilities include:

1. Budgeting and Forecasting

Administrative Accountants take on a central role in the development and maintenance of budgets and forecasts. They collaborate with various departments to compile a comprehensive projection of the organisation's financial trajectory. This involves scrutinising historical data, factoring in market trends, and aligning financial goals with overall business objectives. By crafting realistic and strategic budgets, Administrative Accountants provide management with a roadmap for resource allocation and goal attainment.

2. Cost Analysis

Cost analysis is the cornerstone of effective financial management, and Administrative Accountants are at the forefront of this endeavour. They meticulously dissect the costs associated with production, operations, and other business activities. This granular examination not only identifies areas of inefficiency but also empowers management to make informed decisions about cost optimisation. By conducting cost analyses, Administrative Accountants contribute to enhancing the overall efficiency and competitiveness of the organisation.

3. Performance Evaluation

Administrative Accountants serve as evaluators of organisational performance, assessing the effectiveness of various departments, projects, or products. Through the lens of financial data, they measure the efficiency and productivity of different facets of the business. This critical function provides management with insights into what is working well and what areas need improvement. The performance evaluation conducted by Administrative Accountants serves as a compass for strategic decision-making and resource allocation.

4. Financial Reporting

Generating accurate and comprehensible financial reports is a key responsibility of Administrative Accountants. They translate complex financial data into clear and concise reports for management consumption. These reports often include financial statements, budget versus actual analyses, and variance reports. By presenting information in a digestible format, Administrative Accountants empower management to make timely and well-informed decisions.

5. Risk Management

Identifying and assessing financial risks is an ongoing responsibility for Administrative Accountants. They play a proactive role in identifying potential threats to the organisation's financial stability and devising strategies to mitigate these risks. This involves a thorough understanding of market dynamics, regulatory changes, and other external factors that may impact the organisation. By integrating risk management into their responsibilities, Administrative Accountants contribute to the resilience and adaptability of the business in a dynamic environment.

In essence, the roles and responsibilities of Administrative Accountants extend beyond the traditional realms of accounting. They emerge as strategic partners to management, providing the financial intelligence needed to navigate the complexities of modern business. Through budgeting, cost analysis, performance evaluation, financial reporting, and risk management, Administrative Accountants lay the foundation for informed decision-making, ensuring the organisation's financial compass points in the direction of sustainable growth and success.

Table 1: Key Performance Indicators (KPIs) for Administrative Accountants

Key Performance Indicator | Description |

Cost Analysis Efficiency | Analysing costs for optimal resource allocation |

Budget Adherence | Ensuring adherence to budgetary guidelines |

Strategic Decision Support | Providing insights for informed strategic decisions |

Risk Mitigation Impact | Identifying and mitigating financial risks proactively |

Performance Evaluation | Evaluating and optimising departmental and project performance |

Why Is Administrative Accounting Important in an Organisation?

The significance of Administrative Accounting lies in its ability to empower organisations with the insights needed to make informed decisions and drive success. Here are key reasons why it is indispensable:

Strategic Decision-Making

Administrative Accounting serves as the bedrock for strategic decision-making within an organisation. By providing timely and relevant financial information, Administrative Accountants empower management to make informed choices that align with overarching business objectives. Whether it's launching a new product, entering a new market, or restructuring operations, the insights derived from Administrative Accounting ensure that decisions are grounded in financial prudence and long-term sustainability.

Resource Optimisation

In a world where resources are finite and competition is fierce, organisations must optimise their use of resources to thrive. Administrative Accountants play a pivotal role in this optimisation process. Through detailed cost analyses and performance evaluations, they identify areas where resources can be deployed more efficiently. This not only contributes to cost savings but also enhances the overall productivity and competitiveness of the organisation.

Performance Measurement

Administrative Accounting provides the tools and metrics needed to measure the performance of various business units, projects, or products. These measurements go beyond mere financial indicators, encompassing key performance indicators (KPIs) that align with organisational goals. By systematically evaluating performance, Administrative Accountants contribute to a culture of continuous improvement, accountability, and transparency within the organisation.

Risk Mitigation

Financial risks are inherent in the business landscape, and effective risk management is imperative for sustained success. Administrative Accountants are at the forefront of identifying, assessing, and mitigating financial risks. By conducting thorough risk analyses, they enable organisations to develop strategies to proactively manage uncertainties. This forward-looking approach safeguards the organisation against potential pitfalls and ensures resilience in the face of a dynamic and unpredictable business environment.

Informed Planning and Budgeting

Administrative Accountants are instrumental in the development of organisational plans and budgets. Through meticulous analysis of historical data, market trends, and internal capabilities, they create realistic and achievable financial plans. These plans not only serve as guides for resource allocation but also facilitate goal-setting and performance expectations. Informed planning and budgeting, facilitated by Administrative Accounting, provide a structured framework for the organisation's journey toward success.

Alignment with Organisational Goals

Administrative Accounting ensures that financial activities are aligned with the broader goals and strategies of the organisation. By providing a tailored and internal perspective on financial data, Administrative Accountants enable management to make decisions that harmonise with the organisation's mission, vision, and values. This alignment fosters a cohesive and purpose-driven approach to financial management.

In essence, Administrative Accounting is the compass that steers an organisation through the complexities of financial management. Its importance lies not only in the accuracy and reliability of financial data but also in the ability to transform that data into actionable insights. By facilitating strategic decision-making, resource optimisation, performance measurement, risk mitigation, and informed planning, Administrative Accounting becomes the cornerstone of a resilient and successful organisation. In a world where financial acumen is synonymous with strategic advantage, the role of Administrative Accounting cannot be overstated.

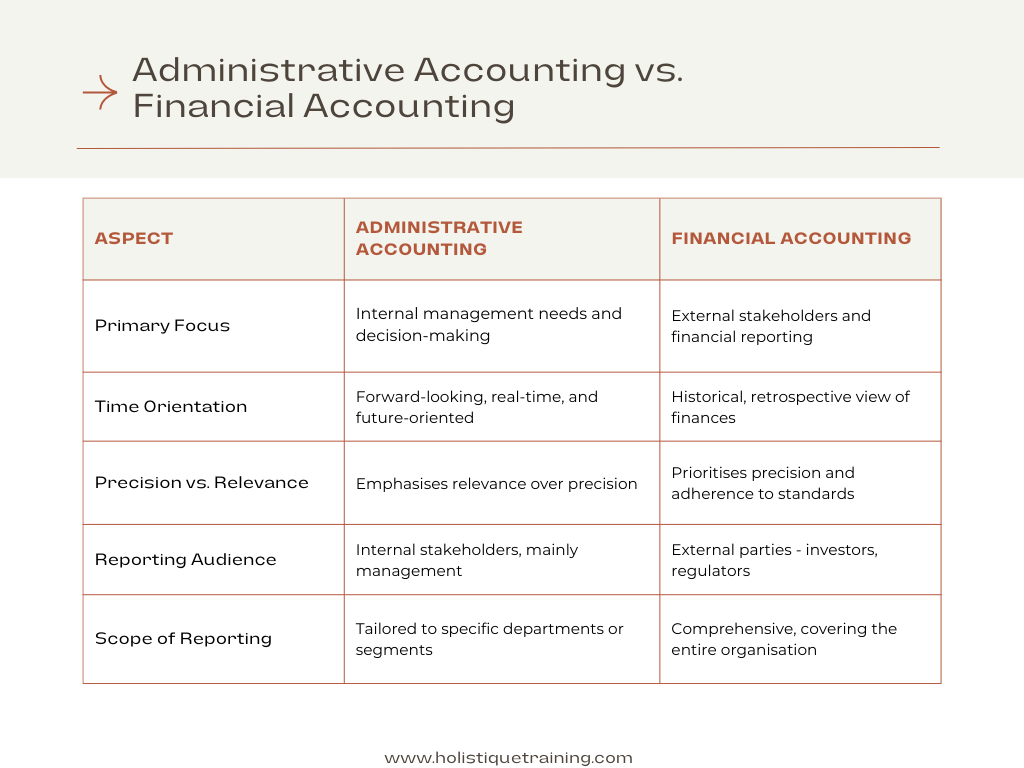

Administrative Accounting vs. Financial Accounting

While both Administrative Accounting and Financial Accounting deal with financial information, they serve distinct purposes within the corporate landscape.

1. External vs. Internal Focus

Financial Accounting:

Financial Accounting primarily caters to external stakeholders, such as investors, creditors, regulators, and the general public. Its purpose is to provide a standardised and comprehensive overview of an organisation's financial health. This includes producing financial statements—such as the balance sheet, income statement, and cash flow statement—that adhere to established accounting principles (GAAP or IFRS).

Administrative Accounting:

In contrast, Administrative Accounting is internally oriented. It tailors financial information to meet the specific needs of internal stakeholders, particularly management. The focus is on providing timely and relevant data for decision-making and strategic planning within the organisation.

2. Historical vs. Forward-Looking

Financial Accounting:

Financial Accounting is primarily concerned with historical data. It documents past transactions and events to present a retrospective view of the organisation's financial performance over a specific period. Its purpose is to provide an accurate representation of the company's financial position for external parties.

Administrative Accounting:

Administrative Accounting, on the other hand, is forward-looking. It deals with real-time data and projections, offering insights into future financial scenarios. This forward-looking perspective enables management to make proactive decisions and plan for the organisation's future.

3. Precision vs. Relevance

Financial Accounting:

Financial Accounting places a premium on precision and adherence to established accounting standards. The goal is to produce financial statements that accurately reflect the financial position of the organisation, ensuring consistency and comparability across different entities.

Administrative Accounting:

Administrative Accounting prioritises relevance over precision. The information provided is customised to address specific managerial needs. This may involve using estimates and projections that are not subject to the same level of standardisation as those in Financial Accounting.

4. External Reporting vs. Internal Decision-Making

Financial Accounting:

The primary output of Financial Accounting is external financial reports. These reports are disseminated to parties outside the organisation, such as investors, lenders, and regulatory bodies. The information is intended to be transparent, standardised, and accessible to a broad audience.

Administrative Accounting:

Administrative Accounting, on the other hand, focuses on internal reporting. Its outputs, such as management reports, budgets, and performance analyses, are designed for the consumption of internal stakeholders, particularly management and department heads. The emphasis is on providing actionable insights for decision-making.

5. Regulatory Compliance vs. Managerial Needs

Financial Accounting:

Compliance with accounting standards and regulations is a cornerstone of Financial Accounting. Entities are required to follow standardised reporting guidelines to ensure transparency and comparability across the business landscape.

Administrative Accounting:

Administrative Accounting is more flexible and adaptable to the specific needs of the organisation. It may involve the use of non-GAAP measures and customised reporting formats to better address the nuances of internal decision-making.

6. Scope of Reporting

Financial Accounting:

The scope of reporting in Financial Accounting is broad and encompasses the entire organisation. It provides a comprehensive view of the company's financial performance, position, and cash flows.

Administrative Accounting:

Administrative Accounting may focus on specific segments or departments within the organisation, tailoring its reports to the unique requirements of different managerial levels.

In summary, while both Administrative Accounting and Financial Accounting deal with financial information, they diverge in their audience, purpose, time focus, precision, and scope. Financial Accounting is concerned with producing standardised external financial reports for a broad audience, ensuring compliance with regulations. In contrast, Administrative Accounting is internally focused, providing customised, forward-looking information to facilitate managerial decision-making and strategic planning within the organisation. Understanding the distinctions between these two realms is essential for appreciating their complementary roles in the holistic financial management of an organisation.

Example of Administrative Accounting

To illustrate the practical application of Administrative Accounting, let's consider a manufacturing company. An Administrative Accountant in this context may:

Develop a Budget

Create a comprehensive budget outlining projected costs and revenues for the upcoming year, considering factors like raw material prices, labour costs, and market trends.

Analyse Production Costs

Break down the costs associated with each product line, identifying opportunities to enhance efficiency and reduce production expenses.

Provide Cost-Volume-Profit Analysis

Assess the relationship between production volume, costs, and profits to help management make informed decisions about production levels and pricing.

Conduct Variance Analysis

Compare actual financial performance against budgeted figures, identifying variances and investigating the reasons behind them.

Qualifications for Administrative Accountants

Embarking on a career in Administrative Accounting demands a blend of education, experience, and professional certifications. Here's a breakdown:

1. Education

Minimum Requirement:

A bachelor's degree in accounting, finance, or a related field is typically the minimum educational requirement for entry into Administrative Accounting roles. This foundational education provides a comprehensive understanding of accounting principles, financial management, and business operations.

Advanced Degrees:

Many Administrative Accountants choose to pursue advanced degrees to enhance their knowledge and career prospects. A Master's in Business Administration (MBA) with a concentration in accounting or finance is a common choice, providing a broader business perspective and deeper financial acumen.

2. Experience

Entry-Level Positions:

While a solid educational background is crucial, practical experience is equally vital. Entry-level positions may require a few years of relevant experience, often gained through internships, co-op programs, or entry-level accounting roles. This hands-on experience helps individuals apply theoretical knowledge to real-world scenarios and develop practical skills.

Mid-to-Senior Level Roles:

As professionals progress in their careers, the importance of experience grows. Mid-to-senior level Administrative Accountant roles often demand a more extensive track record in managerial accounting, financial analysis, and strategic planning. This experience contributes to a deeper understanding of organisational dynamics and industry-specific challenges.

3. Certifications

Certified Management Accountant (CMA):

The CMA designation is a widely recognised certification for Administrative Accountants. Offered by the Institute of Management Accountants (IMA), the CMA certification validates expertise in financial planning, analysis, control, decision support, and professional ethics.

Chartered Global Management Accountant (CGMA):

Issued by the American Institute of CPAs (AICPA) in partnership with the Chartered Institute of Management Accountants (CIMA), the CGMA designation emphasises a global perspective on management accounting. It signifies proficiency in business strategy, risk management, and performance management.

Other Relevant Certifications:

Depending on industry and specialisation, Administrative Accountants may pursue additional certifications, such as Certified Public Accountant (CPA), Certified Internal Auditor (CIA), or certifications specific to certain enterprise resource planning (ERP) systems like SAP or Oracle.

4. Continuous Professional Development

Stay Informed:

Given the dynamic nature of the business and accounting landscapes, staying informed about emerging trends, technological advancements, and regulatory changes is crucial. Continuous learning through workshops, seminars, and professional development courses ensures that Administrative Accountants remain at the forefront of their field.

Networking and Professional Associations:

Active participation in professional associations, such as the Institute of Management Accountants (IMA) or the Association of Chartered Certified Accountants (ACCA), provides opportunities for networking, knowledge exchange, and access to resources that support ongoing professional growth.

5. Soft Skills

Communication Skills

Administrative Accountants need strong communication skills to convey complex financial information to non-financial stakeholders. This includes the ability to present findings, discuss budgetary matters, and collaborate with cross-functional teams.

Analytical and Critical Thinking

Analytical skills are fundamental for interpreting financial data, conducting variance analysis, and making strategic recommendations. Critical thinking skills allow Administrative Accountants to assess situations, identify trends, and propose solutions.

Ethical Judgement

As custodians of financial information, Administrative Accountants must uphold the highest ethical standards. Ethical judgement is crucial when dealing with sensitive financial matters and ensuring compliance with regulatory requirements.

In summary, a successful career as an Administrative Accountant requires a balanced combination of education, practical experience, and relevant certifications. While a strong academic foundation lays the groundwork, hands-on experience and professional certifications contribute to the depth and breadth of expertise. Continuous learning, soft skills development, and ethical judgement are essential components that elevate Administrative Accountants from financial professionals to strategic partners in organisational success.

Pursuing a Career As an Administrative Accountant: Is It Worth It?

Navigating the waters of Administrative Accounting can be a rewarding journey for those passionate about numbers and strategic decision-making. Here are some aspects to consider:

1. Intellectual Stimulation

The field of Administrative Accounting is intellectually rewarding, appealing to individuals who enjoy deciphering complex financial puzzles. As an Administrative Accountant, you engage in detailed analysis, interpretation of financial data, and strategic planning. This continuous intellectual challenge keeps the profession dynamic and provides a sense of accomplishment as you unravel financial intricacies to guide sound decision-making.

2. Career Growth

Administrative Accountants are positioned as integral contributors to organisational success, paving the way for significant career growth. Starting from entry-level positions, individuals can climb the corporate ladder into senior management roles. The skills acquired in Administrative Accounting are transferable across industries, offering the flexibility to explore various sectors and advance into leadership positions.

3. Versatility

One of the distinctive features of a career in Administrative Accounting is its versatility. The skills acquired—ranging from budgeting and cost analysis to strategic planning and risk management—are applicable across diverse business environments. This versatility allows Administrative Accountants to navigate various industries, contributing their financial acumen to different organisational landscapes.

4. Intellectual Fulfilment

For those who find satisfaction in solving financial challenges and contributing to strategic planning, a career in Administrative Accounting provides a profound sense of intellectual fulfilment. The ability to shape an organisation's financial future, optimise resources, and contribute to its success fosters a deep sense of purpose and accomplishment.

5. Continuous Learning Opportunities

The field of Administrative Accounting is ever-evolving, presenting ample opportunities for continuous learning. Whether it's staying abreast of regulatory changes, advancements in accounting technology, or emerging trends in financial management, Administrative Accountants are constantly engaged in expanding their knowledge base. This commitment to learning not only enhances professional competence but also ensures relevance in a dynamic business environment.

6. Strategic Impact

Administrative Accountants are not merely number crunchers; they are strategic partners in organisational decision-making. The financial insights they provide influence strategic initiatives, guide resource allocation, and contribute to the overall success of the organisation. This strategic impact elevates Administrative Accountants from being financial professionals to key contributors in shaping the future trajectory of the business.

7. Flexibility and Transferable Skills

The skills acquired in Administrative Accounting are highly transferable. This flexibility allows professionals to explore different industries, move between sectors, or even transition into related fields. The ability to adapt and apply financial expertise in various contexts provides a level of professional freedom that can be both enriching and fulfilling.

8. Salary and Growth

The Bureau of Labor Statistics (BLS), as cited by Learn.org, forecasted a 7% growth in job opportunities for accountants and auditors from 2020 to 2030, representing average expansion. Those holding CPA certification or a master's degree are likely to encounter increased prospects. According to the BLS data from 2020, the annual average salary for accountants and auditors stood at $81,660.

In conclusion, pursuing a career as an Administrative Accountant is undoubtedly worth the investment. The intellectual stimulation, potential for career growth, versatility, continuous learning opportunities, strategic impact, and transferable skills make this profession a rewarding and dynamic choice. As financial architects of an organisation, Administrative Accountants play a crucial role in shaping its financial health and contributing to its long-term success, making the pursuit of this career path both fulfilling and worthwhile.

Conclusion

In conclusion, Administrative Accounting serves as the compass guiding organisations through the dynamic landscape of financial management. From budgeting and cost analysis to risk mitigation and strategic planning, the impact of Administrative Accounting reverberates throughout the corporate world. For those considering a career in this field, the blend of education, experience, and certifications opens doors to a profession that is both intellectually stimulating and strategically vital. As the financial architects of an organisation, Administrative Accountants shape the future of businesses, making the pursuit of this career path undeniably worth the investment.

In your pursuit of a rewarding career in Administrative Accounting, equip yourself with the essential skills through our transformative course: ‘Accounting and Finance for Non-Financial Professionals.’ Tailored for individuals aspiring to master the nuances of financial management, this course goes beyond the numbers, providing practical insights into budgeting, cost analysis, and strategic decision-making. Whether you're starting your journey or looking to enhance your expertise, our course offers a comprehensive foundation led by industry experts. Unleash your financial potential and become a strategic asset to your organisation. Enrol now and embark on a transformative learning experience that propels your career to new heights!

Frequently Asked Questions(FAQ)

What distinguishes Administrative Accounting from Financial Accounting?

Administrative Accounting focuses on internal management needs, providing forward-looking, tailored financial information. In contrast, Financial Accounting caters to external stakeholders, offering a retrospective, standardised view of an organisation's financial health.

How does Administrative Accounting contribute to strategic decision-making?

Administrative Accountants provide timely and relevant financial insights, empowering management to make informed decisions aligned with organisational goals. Their forward-looking perspective aids in strategic planning, resource optimisation, and risk mitigation.

What qualifications are necessary for a career in Administrative Accounting?

To pursue a career in Administrative Accounting, a bachelor's degree in accounting or a related field is essential. Advanced degrees, such as an MBA, and professional certifications like CMA or CGMA, enhance credibility and career prospects.

Why is continuous learning crucial for Administrative Accountants?

The dynamic nature of business demands ongoing adaptation. Continuous learning allows Administrative Accountants to stay informed about industry trends, regulatory changes, and technological advancements, ensuring they remain at the forefront of their field.

How does Administrative Accounting impact an organisation's success?

Administrative Accountants play a crucial role in optimising resources, measuring performance, and providing strategic insights. Their contributions shape the financial health of the organisation, positioning them as key contributors to long-term success.